Interactive SIP Calculator Tool

Unlock Your Financial Future with SIP Investing

See how your small monthly investments can grow into a substantial wealth over time through the power of compounding.

SIP Calculator

Results

Total Invested Amount: ₹0

Estimated Returns: ₹0

Total Value: ₹0

Ready to Start Your Investment Journey?

Take the first step toward financial freedom by starting your SIP today!

Start Investing NowSIP Calculator: Estimating Your Future Wealth

Hello, friends! Welcome to my new finance blog, where I’m diving deep into the world of mutual funds—a topic close to my heart after 20 years of blogging across various niches. Today, I’m super excited to talk about something that’s a game-changer for anyone looking to grow their money steadily: the SIP calculator. Whether you’re a beginner just starting your investment journey or a seasoned pro-fine-tuning your portfolio, this tool is your best friend. So, grab a cup of chai (or coffee, if you’re reading this from the USA or Europe!), and let’s explore how an SIP calculator India can help you estimate your future wealth through systematic investments.

Imagine this: You’re planning a dream vacation to the beaches of Goa or maybe saving up for your child’s education. But how do you turn those dreams into reality without breaking the bank? That’s where Systematic Investment Plans (SIPs) and the magic of an SIP calculator come in. In this post, I’ll walk you through what an SIP is, why it’s awesome, how the calculator works, and how it can project your SIP return estimation. Plus, I’ll share some real-life stories, handy tips, and even a fun tool to play with. Let’s get started!

What Is an SIP, and Why Should You Care?

Let’s begin with the basics. A SIP, or Systematic Investment Plan, is like a disciplined savings habit. Instead of dumping a big chunk of money into a mutual fund all at once, you invest a fixed amount regularly—say, every month or quarter. Think of it as paying yourself first, but instead of stashing cash under your mattress, you let it grow in a mutual fund.

Why is this cool? Because it’s affordable (you can start with as little as ₹500 in India!), and it uses two powerful ideas: compounding and rupee-cost averaging. Compounding is like a snowball effect—your money earns returns, and those returns earn more returns over time. Rupee-cost averaging means you buy more units when prices are low and fewer when prices are high, smoothing out market ups and downs.

Now, here’s where the SIP Calculator India steps in. It’s an online tool that helps you figure out how much your SIP could grow over time. Whether you’re investing with big names like SBI Mutual Fund, HDFC Mutual Fund, or ICICI Prudential Mutual Fund (all top AMCs in India), this calculator gives you a sneak peek into your future wealth.

How Does an SIP Calculator Work?

Okay, let’s break this down with a simple story. Meet Priya, a 28-year-old teacher from Mumbai. Priya earns ₹40,000 a month and wants to save for a house down payment in 10 years. She decides to invest ₹5,000 monthly in a mutual fund SIP. But she’s curious—how much will she have after a decade?

This is where the SIP calculator shines. It takes three main inputs:

- Monthly Investment Amount: How much you’ll invest each month (₹5,000 for Priya).

- Investment Tenure: How long you’ll keep investing (10 years in her case).

- Expected Rate of Return: The annual growth rate you expect (let’s say 12%, a reasonable average for equity mutual funds in India).

The calculator uses a formula to estimate the future value:

Future Value = P × {[(1 + r)^n – 1] / r} × (1 + r)

- P = Monthly investment

- r = Monthly rate of return (annual rate ÷ 12)

- n = Number of months

For Priya:

- P = ₹5,000

- r = 12% ÷ 12 = 1% (0.01)

- n = 10 years × 12 = 120 months

Plugging this into an SIP calculator India, she’d get a future value of about ₹11.62 lakh! Her total investment would be ₹6 lakh (₹5,000 × 120), and the rest—₹5.62 lakh—is the magic of compounding. Cool, right?

Why Use a SIP Calculator India?

You might be wondering, “Why not just guess or calculate manually?” Well, here’s why a SIP calculator is a must-have:

- Saves Time: No need for complex math—just enter your numbers and voilà!

- Customizable: Play with different amounts, tenures, and rates to see what works for you.

- Goal Planning: Want ₹50 lakh for retirement? The calculator tells you how much to invest monthly.

- Clarity: It breaks down your total investment versus gains, so you know exactly what’s happening.

Take Raj, a 35-year-old IT guy from Bangalore. He used an SIP calculator to plan for his daughter’s education. By tweaking the numbers, he realized that investing ₹10,000 monthly at 10% for 15 years could grow to ₹41.72 lakh—enough to cover her college fees!

Top Indian AMCs for Your SIP Investments

India’s mutual fund market is buzzing with trusted Asset Management Companies (AMCs). Here’s a quick list of some popular ones you can explore for your SIPs:

- SBI Mutual Fund: Known for solid equity funds like SBI Small Cap Fund.

- HDFC Mutual Fund: Offers favourites like HDFC Mid-Cap Opportunities Fund.

- ICICI Prudential Mutual Fund: Great for balanced funds like ICICI Pru Equity & Debt Fund.

- Axis Mutual Fund: Loved for Axis Bluechip Fund.

- Nippon India Mutual Fund: Home to Nippon India Growth Fund.

- Aditya Birla Sun Life Mutual Fund: Strong in diversified equity funds.

- UTI Mutual Fund: A pioneer with UTI Nifty Index Fund.

Each AMC offers SIP options and the SIP calculator India works with any of them. Just pick a fund based on your risk appetite—equity for high returns, debt for stability, or hybrid for a mix—and let the calculator do the rest.

Real-Life Examples: SIP Success Stories

Let’s sprinkle some inspiration into this. Meet Anil, a 40-year-old shopkeeper from Delhi. Back in 2010, he started a ₹2,000 monthly SIP with SBI Mutual Fund. He chose an equity fund with an average return of 13%. Fast forward to 2025 (15 years later), and his ₹3.6 lakh investment has grown to ₹11.5 lakh! Anil used this to fund his son’s wedding—proof that small steps lead to big wins.

Then there’s Maria, a 32-year-old freelancer from Chennai. She started with ₹1,000 monthly in 2018, using HDFC Mutual Fund’s small-cap fund (15% average return). By 2025, her ₹84,000 investment is worth ₹1.68 lakh. She’s now planning a solo trip to Europe!

These stories show how an SIP calculator India can turn dreams into plans. It’s not just numbers—it’s your future.

Breaking Down SIP Return Estimation

Let’s get a bit technical (but still simple!). The SIP return estimation depends on:

- Market Performance: Equity funds might give 10-15% annually, while debt funds offer 6-8%.

- Time Horizon: Longer tenures mean more compounding power.

- Consistency: Missing SIPs can dent your returns, so stick to it!

Here’s a table to show how ₹5,000 monthly grows at different rates and tenures:

| Tenure (Years) | 8% Return | 12% Return | 15% Return |

|---|---|---|---|

| 5 | ₹3.67 lakh | ₹4.12 lakh | ₹4.49 lakh |

| 10 | ₹9.14 lakh | ₹11.62 lakh | ₹13.58 lakh |

| 15 | ₹17.19 lakh | ₹25.23 lakh | ₹32.46 lakh |

See the difference? A higher rate or longer time can double or triple your wealth! Use an SIP calculator to tweak these numbers for your goals.

Step-by-Step Guide to Using an SIP Calculator India

Ready to try it yourself? Here’s how:

- Find a Calculator: Most AMC websites (like SBI MF or ICICI Pru) or platforms like Groww and ET Money have free tools.

- Enter Your Amount: Say, ₹10,000 monthly.

- Pick a Tenure: Maybe 20 years for retirement.

- Choose a Rate: 12% is a good average for equity funds.

- Hit Calculate: Watch the magic happen!

For ₹10,000 monthly at 12% for 20 years, you’d invest ₹24 lakh and end up with ₹99.96 lakh. That’s ₹75.96 lakh in gains—mind-blowing, right?

Tips to Maximize Your SIP Returns

Want to supercharge your SIP? Here’s how:

- Start Early: Even ₹1,000 monthly at age 25 can beat ₹10,000 at 35 over 30 years.

- Step-Up SIPs: Increase your amount yearly (e.g., 10% more as your salary grows).

- Diversify: Mix equity, debt, and hybrid funds via AMCs like UTI or Nippon India.

- Review Regularly: Use the SIP calculator annually to adjust your plan.

Common Mistakes to Avoid

I’ve seen folks stumble, so let’s dodge these pitfalls:

- Chasing High Returns: 20% sounds tempting, but it’s risky. Stick to realistic rates (10-15%).

- Stopping Early: Markets dip? Don’t panic—SIPs thrive on time.

- Ignoring Fees: Check expense ratios of funds from AMCs like Axis or Aditya Birla.

Let’s Calculate Your Own Corpus Using SIP Calculator!

To make this fun and interactive, I’ve created a simple SIP calculator tool for you to try right here. Enter your details below, hit “Calculate,” and see your future wealth unfold!

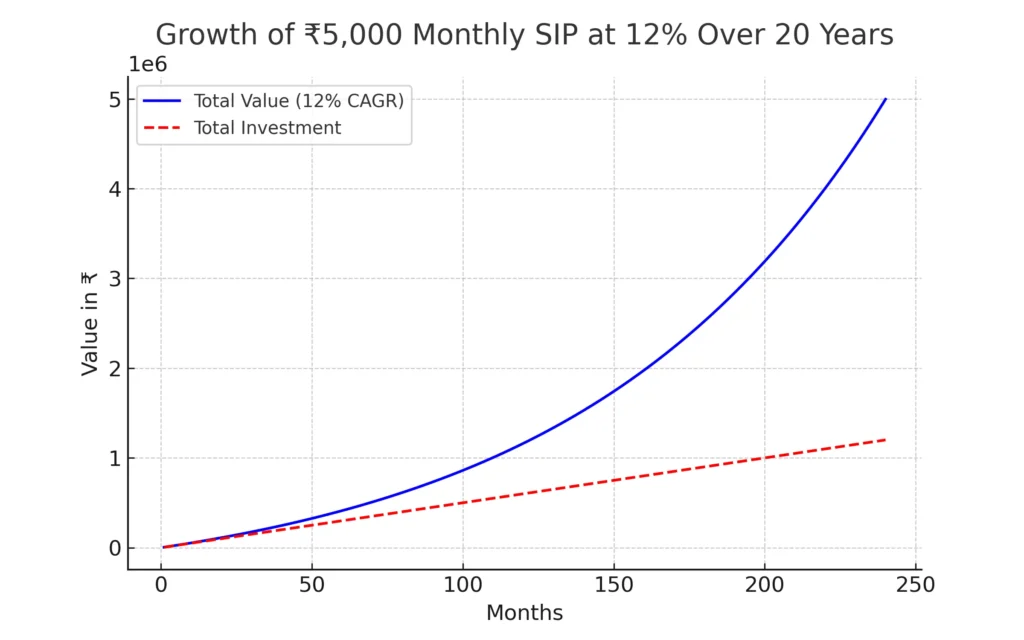

Visualizing Your Growth: A Graph

Here’s a quick graph showing ₹5,000 monthly at 12% over 20 years:

Your Next Steps

So, what’s your takeaway? The SIP calculator India isn’t just a tool—it’s your roadmap to financial freedom. Whether you’re with SBI, HDFC, or any Indian AMC, it helps you plan with confidence. Start small, stay consistent, and watch your wealth grow.

Got a goal in mind? Drop it in the comments—let’s calculate it together! And if you loved this, share it with your friends in India, the USA, Europe, or Australia. Let’s build wealth, one SIP at a time!