Gold Prices in India Hit ₹1 Lakh: What It Means for Investors in 2025

Gold has always held a special place in Indian hearts, culture, and portfolios. But in April 2025, something extraordinary happened—gold prices in India soared to an unprecedented ₹1 lakh per 10 grams. This historic milestone is more than just a headline; it signals a fundamental shift in the financial landscape for investors, both seasoned and new.

In this detailed guide, we’ll explore why this surge happened, what it means for investors, and how you can position yourself smartly in this evolving market.

The Current Gold Price Trend in India (2025)

The gold price trend in India in 2025 has stunned many. According to data from the India Bullion and Jewellers Association (IBJA), prices rose nearly 20% in just the first four months of the year, reaching ₹1 lakh per 10 grams by mid-April.

Here’s a quick breakdown of the gold price trend:

| Month | Price (10g) | % Increase from Jan 2025 |

|---|---|---|

| Jan 2025 | ₹83,000 | – |

| Feb 2025 | ₹87,500 | 5.4% |

| Mar 2025 | ₹93,000 | 11.9% |

| Apr 2025 | ₹100,000 | 20.5% |

Source: India Bullion and Jewellers Association

This growth is not a fluke; it is driven by multiple domestic and global factors that we need to understand.

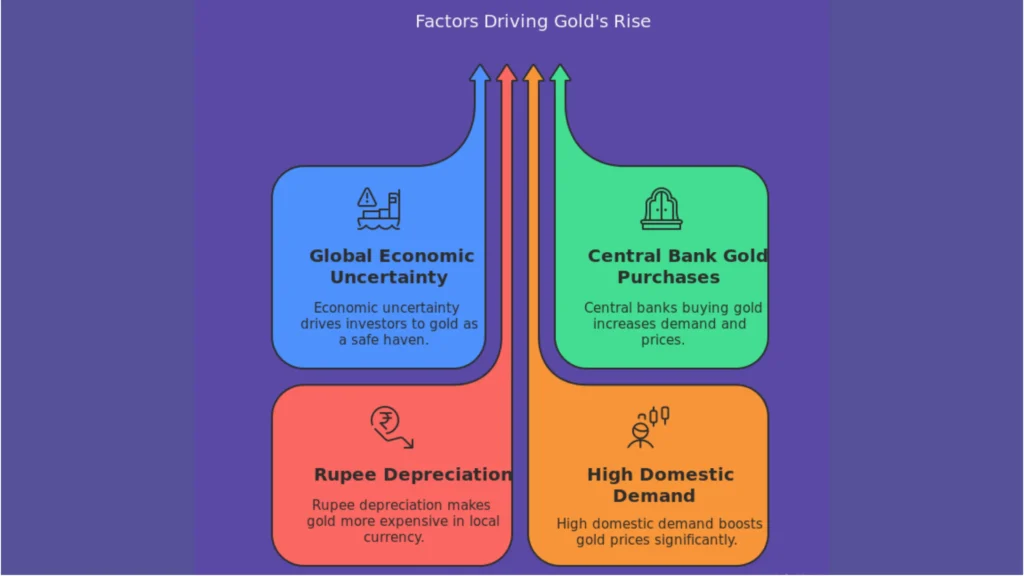

What’s Driving the Surge in Gold Prices?

1. Global Economic Uncertainties

The ongoing geopolitical tensions, inflation fears, and slow global growth are pushing investors to seek refuge in gold—a tried and tested safe-haven asset.

2. Central Bank Buying Spree

Central banks globally, especially in emerging markets, are accumulating gold to diversify away from the US dollar. According to the World Gold Council, global central banks purchased 1,136 tonnes of gold in 2024 alone, a 12-year high.

3. Rupee Depreciation

The INR weakened against the USD in early 2025, making imported gold more expensive for Indian buyers.

4. Increased Domestic Demand

The wedding season, festivals, and investment demand from retail investors have all contributed to the surge.

What It Means for Indian Investors

For Beginners:

Gold is no longer just a traditional asset or wedding gift; it is a serious investment vehicle. If you’re starting out, consider:

- Sovereign Gold Bonds (SGBs): Government-backed, with fixed interest and no storage cost.

- Digital Gold: Offered by platforms like Paytm, PhonePe, and Groww.

- Gold Mutual Funds/ETFs: Managed by AMCs operational in India like HDFC, ICICI Prudential, Nippon India, SBI, and Axis Mutual Fund.

For Intermediate Investors:

This is a good time to rebalance your portfolio. If gold is more than 15-20% of your assets, consider taking some profit.

For Professionals:

Use gold as a hedge against equity market volatility and inflation. Tactical asset allocation can help you navigate uncertain markets.

Gold Investment Tips for 2025

1. Avoid Physical Gold for Investment

Stick to SGBs or Gold ETFs. They are more secure, liquid, and don’t involve making charges.

2. Buy Gold Online in India

Platforms like Zerodha, HDFC Securities, and Kuvera allow you to buy gold conveniently and often at lower spreads.

3. Track Gold Rate Forecasts

Keep an eye on credible sources like the World Gold Council, RBI reports, and SEBI-registered analysts.

4. Diversify, Don’t Bet It All

Don’t chase gold just because it’s rallying. Maintain a balanced portfolio with equity, debt, and gold.

Is It the Best Time to Buy Gold in India?

That depends on your goals. Historically, gold performs well in times of uncertainty. But prices can correct too. The key is:

- Buy in small amounts: Use a SIP-like strategy for gold (via ETFs or SGBs).

- Avoid panic buying: Don’t buy just because prices are rising.

Gold Price Outlook for 2025

| Scenario | Predicted Price (10g) by Dec 2025 |

| Bullish (high demand) | ₹108,000 – ₹112,000 |

| Moderate (stabilization) | ₹98,000 – ₹102,000 |

| Bearish (correction) | ₹87,000 – ₹93,000 |

Real-Life Example

Let’s take the story of Meera, a 35-year-old working woman from Bengaluru. She had invested ₹50,000 in SGBs in 2020 when gold was priced at ₹48,000 per 10g. Her investment value has now more than doubled. Plus, she received interest every year. This smart decision has now helped her plan for her child’s education abroad.

How SSS Financial Can Help You

At SSS Financial, we understand that every investor’s journey is unique. Whether you’re a first-time buyer or a seasoned pro, we offer customized gold investment strategies tailored to your goals. From identifying the best AMCs for gold mutual funds to helping you understand SGBs and ETFs, we are here to walk with you at every step.

If you’re confused about whether to hold, sell, or buy more gold, let our SEBI-registered advisors help you make an informed decision.

Conclusion

Gold touching ₹1 lakh per 10 grams is a wake-up call for investors. It reflects a shifting global order, rising uncertainty, and renewed interest in this timeless asset. Whether you’re looking to diversify your portfolio, preserve wealth, or simply understand the gold market better—2025 is the year to pay attention.

So, what role will gold play in your financial journey this year?

FAQ

If you’re investing for the long term, staggered buying via SGBs or ETFs is safer than trying to time the market.

Not for investments. Digital formats are safer, more liquid, and don’t involve making or storage charges.

Ideally, 10-15% depending on your risk profile and goals.

Price volatility, currency risk (for Indian buyers), and opportunity cost compared to equity.

Yes, especially if held in the form of digital gold or gold-backed mutual funds.