Unlock Your Financial Future with the Best Financial Calculator Tools in India

Hey there, friends! Imagine this: it’s a cozy Sunday morning, and you’re sipping your favorite chai, dreaming about buying your dream home or retiring early to travel the world. But then, a familiar worry creeps in—“How will I make this happen financially?” Don’t worry, I’ve been there too. As a SEBI-registered Mutual Fund Distributor with over 15 years of overall experience, I’ve seen countless people transform their financial dreams into reality with the right tools and guidance. Today, I’m excited to share a game-changer in your financial journey: financial calculator tools. These tools, offered by my company SSS Financial, are like a trusted friend helping you plan your finances with ease.

In this blog post, we’ll dive deep into the world of financial calculators, explore the ones available on SSS Financial’s website, and give you a sneak peek into what’s coming next. Whether you’re a beginner just starting your financial journey or a seasoned investor, this post is packed with insights, real-life stories, and practical tips to help you achieve your goals. So, grab your notebook, and let’s get started!

Why Financial Calculators Are Your Financial Superpower

Let’s face it—money matters can feel overwhelming. From planning for your dream house to paying off debt, the numbers can seem like a puzzle. That’s where financial calculators come in. These online tools simplify complex calculations, giving you clarity on your financial goals. According to a 2023 survey by the National Financial Educators Council, 65% of Indians feel stressed about financial planning due to a lack of clear tools. Financial calculators bridge this gap by offering quick, accurate, and personalized insights.

At SSS Financial, our mission is to empower you to take control of your finances. Our financial calculator tools are designed to help you plan for mutual funds, insurance, debt repayment, and more. Let’s explore the calculators currently available on our website under the Financial Tools category and how they can transform your financial journey.

Exploring SSS Financial’s Financial Calculator Tools

The Financial Tools section on www.sssfinancial.in is a treasure trove of calculators tailored to your needs. Here’s a detailed look at each one, along with how they can help you:

1. Payoff Calculator

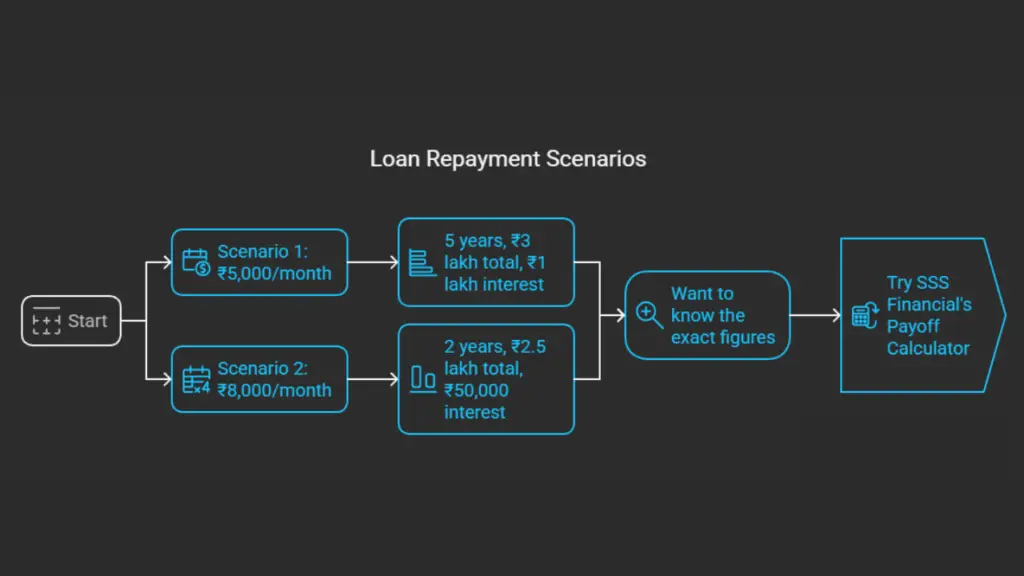

Struggling with credit card debt or a personal loan? The payoff calculator is your go-to tool. It helps you calculate how long it will take to clear your debt and how much interest you’ll pay. Simply input your loan amount, interest rate, and monthly payment, and voilà—you get a clear repayment plan.

Real-Life Example: Meet Pragya, a 30-year-old marketing professional from Mumbai. She had ₹2 lakh in credit card debt with an 18% interest rate. Using our payoff calculator, she discovered that by increasing her monthly payment from ₹5,000 to ₹8,000, she could clear her debt in 2 years instead of 5, saving ₹50,000 in interest. Today, Pragya is debt-free and investing in mutual funds!

How It Helps: The payoff calculator empowers you to create a debt payoff strategy, saving you time and money. Try the Payoff Calculator now.

2. Future Wealth Calculator

Dreaming of financial freedom? The future wealth calculator helps you estimate how your investments in mutual funds or other assets will grow over time. Input your initial investment, monthly SIP (Systematic Investment Plan), expected return rate, and time horizon to see your wealth multiply.

Stats: A 2024 report by AMFI (Association of Mutual Funds in India) shows that SIP investments in India grew by 35% in the last year, with over 9 crore active SIP accounts. This proves Indians are embracing systematic investing!

How It Helps: Whether you’re saving for retirement or a child’s education, this tool shows you the power of compounding. Check out the Future Wealth Calculator.

3. Dream Home Calculator

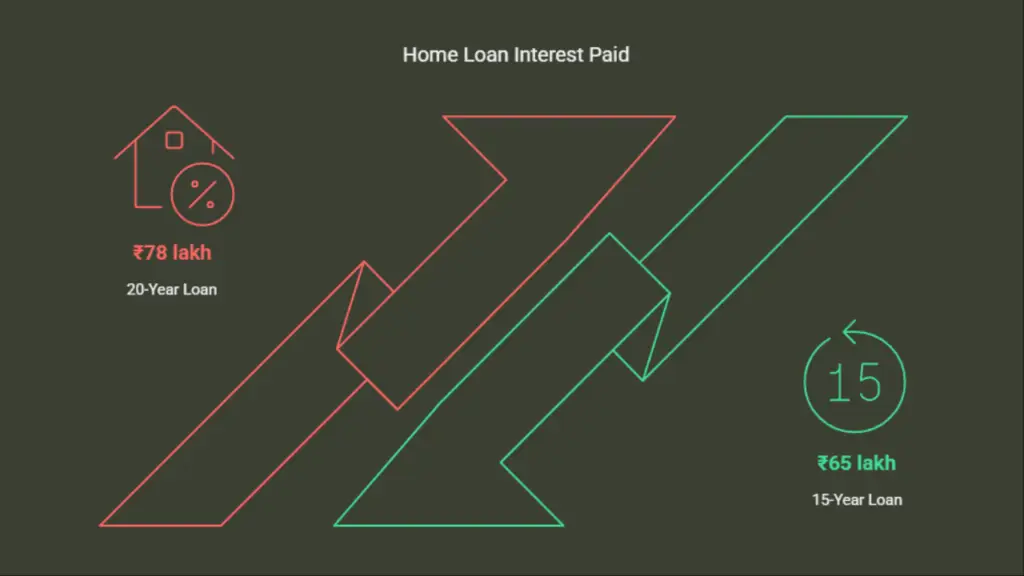

Buying a home is a milestone for many Indians. Our dream home calculator (also called the dream house calculator) helps you estimate how much you need to save for your dream home. Input the property cost, down payment, loan tenure, and interest rate to get a clear picture of your monthly EMI and total loan cost.

Real-Life Example: Rajesh, a 35-year-old IT professional from Bengaluru, wanted to buy a ₹80 lakh home. Using the dream home calculator, he realized that a 20-year loan with a 9% interest rate would mean an EMI of ₹66,000. By adjusting his budget and opting for a 15-year loan, he saved ₹3 lakh in interest. Rajesh now lives in his dream home, thanks to smart planning!

How It Helps: This tool ensures you make informed decisions about home loans. Explore the Dream Home Calculator.

4. NPS Percentage Calculator

The National Pension System (NPS) is a fantastic way to save for retirement. The NPS percentage calculator helps you estimate your retirement corpus based on your monthly contributions, investment tenure, and expected returns. It also shows the percentage of your corpus available as a lump sum versus annuity.

Stats: As per NPS Trust data (2024), over 1.8 crore Indians are enrolled in NPS, with total assets under management crossing ₹12 lakh crore. This shows the growing popularity of NPS as a retirement tool.

How It Helps: Plan your retirement with confidence and ensure a steady income post-retirement. Use the NPS Percentage Calculator.

5. Debt Payoff Calculator

Similar to the payoff calculator, the debt payoff calculator focuses on creating a structured plan to clear multiple debts. It uses strategies like the snowball (paying off smaller debts first) or avalanche (tackling high-interest debts first) method to optimize repayment.

How It Helps: This tool is perfect if you’re juggling multiple loans and want a clear path to becoming debt-free. Try the Debt Payoff Calculator.

What’s Coming Next? A Sneak Peek into Future Tools

At SSS Financial, we’re always innovating to make your financial journey smoother. Here’s a glimpse of what’s in store for our Financial Tools category:

- SIP Step-Up Calculator: Plan for increasing your SIP contributions annually to match your income growth.

- Child Education Planner: Estimate the cost of your child’s higher education and how much to invest now.

- Tax-Saving Investment Calculator: Find the best ELSS (Equity-Linked Savings Scheme) mutual funds to save tax under Section 80C.

- Retirement Income Planner: Calculate how much monthly income you’ll need post-retirement and how to achieve it.

These tools will be integrated into our website soon, making SSS Financial your one-stop solution for financial planning.

Why Choose Financial Calculators Over Manual Planning?

You might wonder, “Why not just use a spreadsheet or pen and paper?” Here’s why financial calculators are a better choice:

- Accuracy: Calculators use precise formulas to eliminate human error.

- Speed: Get results in seconds, not hours.

- Customization: Tailor inputs to your unique financial situation.

- Clarity: Visual charts and graphs make complex data easy to understand.

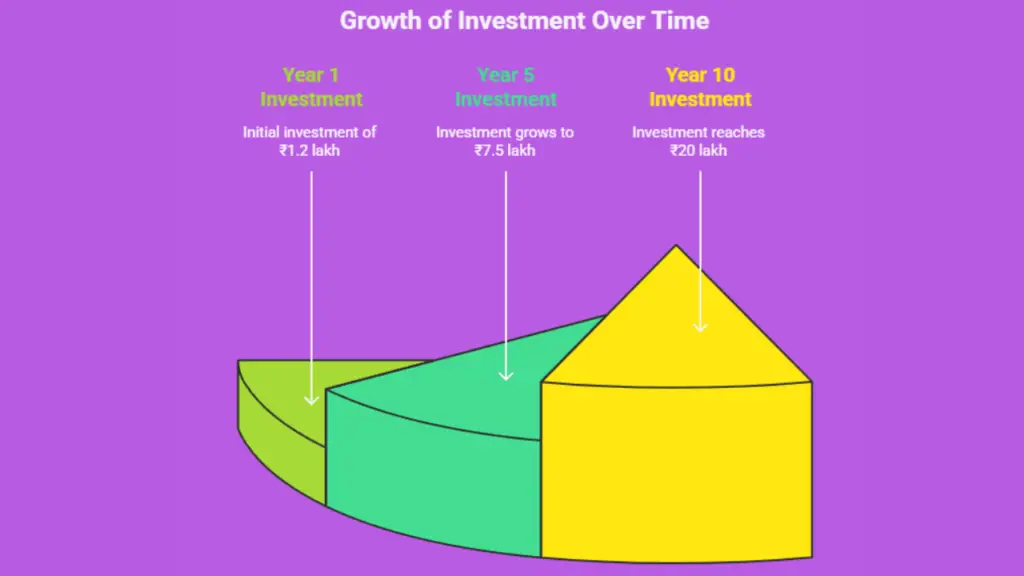

For example, our future wealth calculator generates a graph showing your investment growth over time, like this:

| Year | Investment Value (₹) |

|---|---|

| 1 | 1,20,000 |

| 5 | 7,50,000 |

| 10 | 20,00,000 |

Note: Assumes ₹10,000 monthly SIP at 12% annual return.

This visual aid helps you see the power of compounding at a glance!

How Financial Calculators Solve Real Problems

Let’s talk about the problems our clients face and how our calculators offer solutions:

Problem 1: Overwhelming Debt

Many young professionals in India struggle with credit card debt or personal loans. A 2024 RBI report states that household debt in India has risen by 12% in the last five years. Our payoff calculator and debt payoff calculator help you create a repayment plan, reducing stress and saving money.

Problem 2: Unclear Investment Goals

Investing in mutual funds can feel daunting without clear projections. Our future wealth calculator shows you how small, consistent investments can grow into a substantial corpus, encouraging you to start early.

Problem 3: Home Loan Confusion

Buying a home is a major decision, but loan terms can be confusing. The dream home calculator simplifies EMI calculations, helping you choose the right loan tenure and amount.

Problem 4: Retirement Worries

With rising life expectancy (now 71 years in India, per WHO 2023), retirement planning is crucial. The NPS percentage calculator ensures you save enough for a comfortable retirement.

A Story of Transformation: Meet Anjali

Let me share Anjali’s story to show how these tools can change lives. Anjali, a 28-year-old teacher from Delhi, was drowning in ₹3 lakh of student loan debt and had no savings. She stumbled upon SSS Financial’s website and used the debt payoff calculator to create a repayment plan. By following the avalanche method, she cleared her debt in 3 years. Inspired, she used the future wealth calculator to start a ₹5,000 monthly SIP in an equity mutual fund. Today, at 32, Anjali has ₹4 lakh in savings and is planning to buy her dream home using the dream home calculator.

Anjali’s story proves that with the right tools and guidance, anyone can achieve financial freedom.

AMCs Operational in India: Your Investment Options

As a SEBI-registered Mutual Fund Distributor, I recommend investing through Asset Management Companies (AMCs) operational in India. Here are some top AMCs you can explore:

- SBI Mutual Fund: Known for its diversified equity and debt funds.

- HDFC Mutual Fund: Offers top-performing ELSS and balanced funds.

- ICICI Prudential Mutual Fund: Popular for its blue-chip and mid-cap funds.

- Aditya Birla Sun Life Mutual Fund: Great for long-term wealth creation.

- Axis Mutual Fund: Focuses on high-growth equity funds.

Our future wealth calculator integrates with these AMCs, helping you estimate returns based on their historical performance (e.g., 10–15% for equity funds, per AMFI 2024).

Interactive Element: Test Your Financial IQ

Let’s make this fun! Answer this quick question:

How long will it take to pay off a ₹1 lakh loan at 12% interest with a ₹5,000 monthly payment?

A) 2 years

B) 3 years

C) 4 years

Use our payoff calculator to find out! Share your answer in the comments below!

FAQs: Your Questions Answered

1. What are financial calculators?

Financial calculators are online tools that simplify complex financial calculations, such as loan EMIs, investment growth, or debt repayment plans.

2. How accurate are SSS Financial’s calculators?

Our calculators use industry-standard formulas and are regularly updated to ensure accuracy. However, results depend on the inputs you provide.

3. Are these calculators free to use?

Yes, all calculators on www.sssfinancial.in are free and accessible to everyone.

4. Can I use these calculators for mutual fund investments?

Absolutely! The future wealth calculator is perfect for planning SIPs and lump-sum investments in mutual funds.

5. What’s the difference between the payoff calculator and debt payoff calculator?

The payoff calculator focuses on a single loan, while the debt payoff calculator helps manage multiple debts with strategies like snowball or avalanche.

Conclusion: Start Your Financial Journey Today

Friends, financial planning doesn’t have to be scary. With SSS Financial’s financial calculator tools, you have the power to turn your dreams into reality—whether it’s buying your dream home, becoming debt-free, or retiring comfortably. From the payoff calculator to the NPS percentage calculator, these tools simplify your journey, one step at a time. As Anjali’s story shows, small actions today can lead to big results tomorrow.

So, what’s stopping you? Visit www.sssfinancial.in today, explore our financial calculators, and take the first step toward financial freedom. Which calculator will you try first?